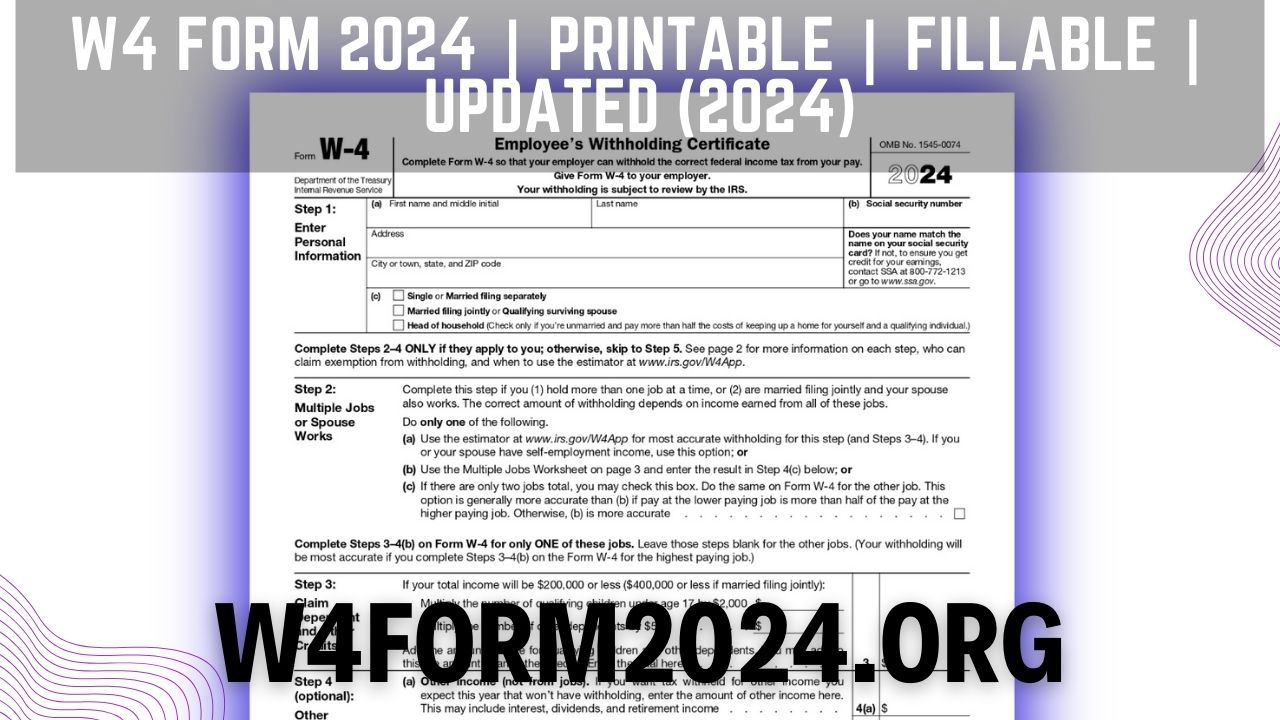

What Is W4 Form 2024

What Is W4 Form 2024. For 2024, if you believe your itemized deductions will exceed $14,600 (if you’re single or married filing separate), $29,200 (if you’re married filing jointly), or $21,900 (if you’re the. Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your.

Your number of idaho allowances; An overview of filling out the w4 tax form.

An Overview Of Filling Out The W4 Tax Form.

You and your employees should understand how to fill out a.

The Drafts Restore References To The Tax Withholding Estimator That Were Removed For 2023.

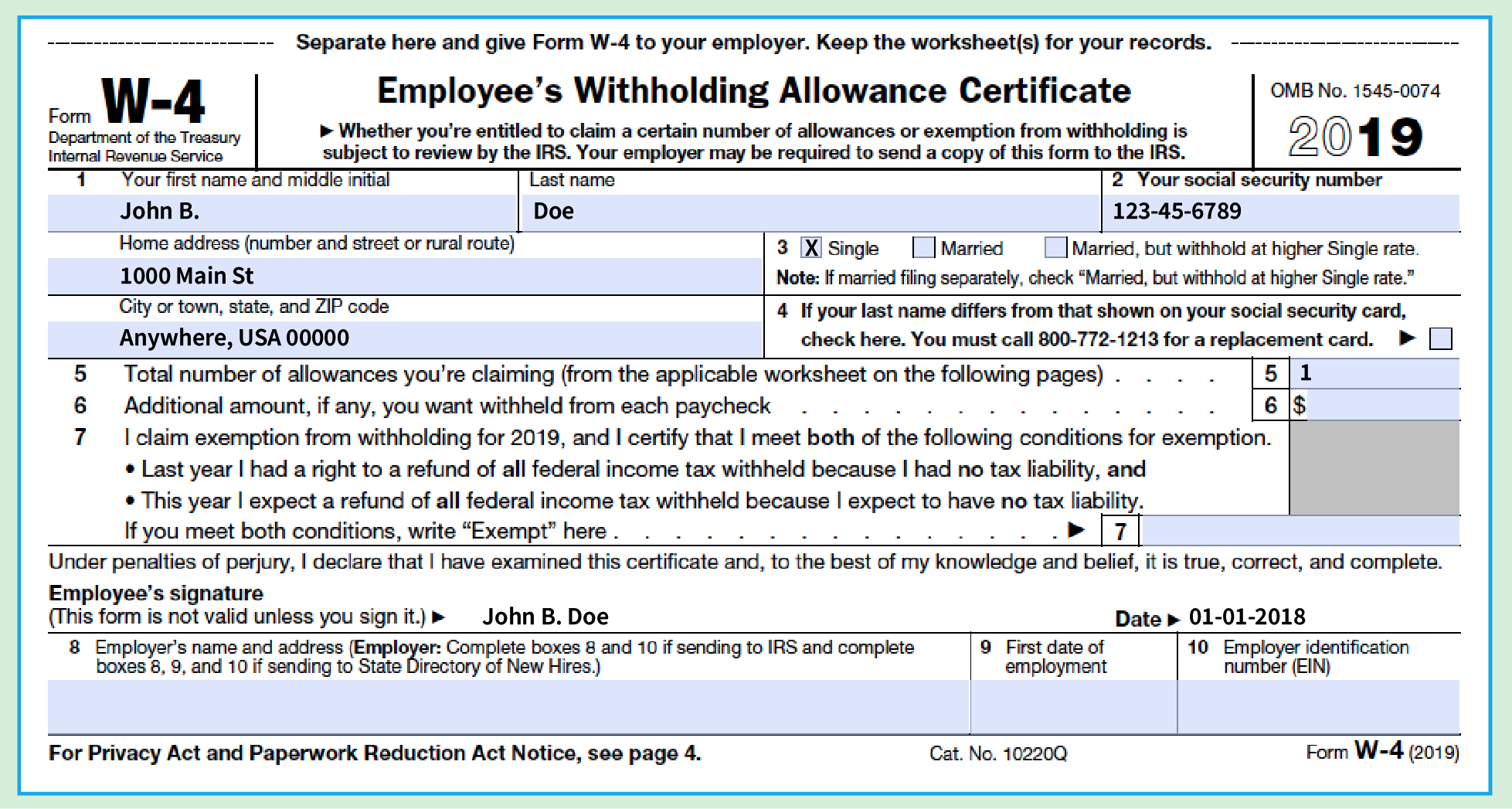

As before, you’ll need to provide your first and last name, social security number, home address, and filing status (single, married filing separately, married.

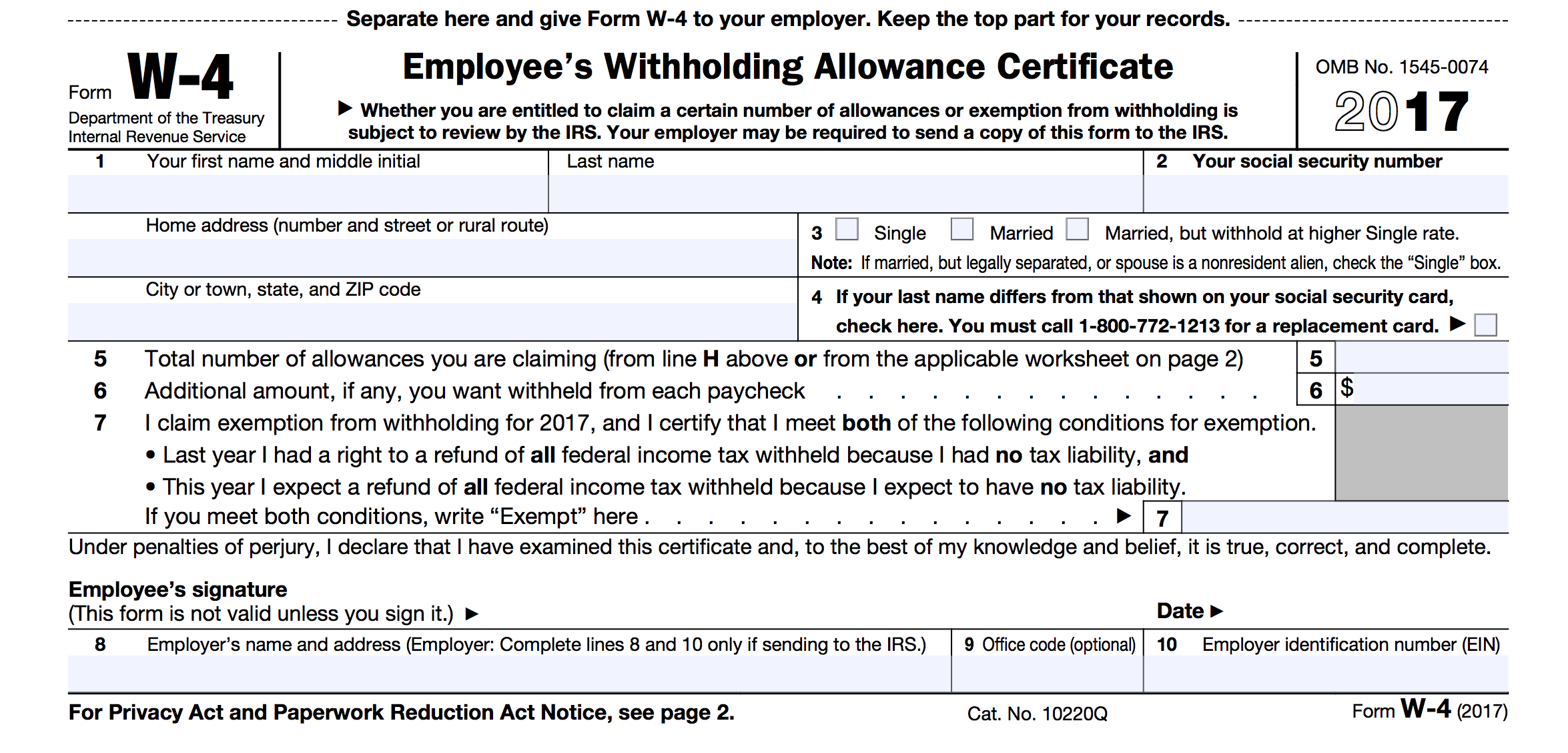

The Irs Routinely Amends Or Changes Its Forms As Tax Laws Change Or Evolve.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, You are allowed to claim between 0 and 3 allowances on this form. Since tax rules change over time and can vary by location and industry, consult a cpa or tax advisor for specific guidance.

Source: w4form2024.org

Source: w4form2024.org

W4 Form 2024 Printable Fillable UPDATED (2024), 2024 michigan income tax withholding guide. Page last reviewed or updated:

Source: w4formsprintable.com

Source: w4formsprintable.com

W 4 Form Printable Version 2022 W4 Form, You and your employees should understand how to fill out a. Department of the treasury internal revenue service.

Source: kalaqemelina.pages.dev

Source: kalaqemelina.pages.dev

W4 Form 2024 How To Fill Out Mona, The form references a new tax withholding estimator for individuals (and their spouses) who have self. The irs routinely amends or changes its forms as tax laws change or evolve.

:max_bytes(150000):strip_icc()/2023FormW-4-64302bb2a6504482bab1e847bbc4cb1a.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Form W4 What It Is and How to File, W4 form 2023 2024, after setting the stage alight with a new, sixy avatar last season, ajinkya rahane hasn't quite found the same rhythm in ipl 2024. As before, you’ll need to provide your first and last name, social security number, home address, and filing status (single, married filing separately, married.

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form W4 (Employee's Withholding Certificate) template, The form references a new tax withholding estimator for individuals (and their spouses) who have self. Since tax rules change over time and can vary by location and industry, consult a cpa or tax advisor for specific guidance.

:max_bytes(150000):strip_icc()/W4eng-b237d0a065e642b1abdba0fa653d8c1b.jpg) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

What Is Form W4?, Learn what changes you might see on this tax form and walk through how to complete it. Your number of idaho allowances;

The new IRS Form W4 has many scratching their heads Here's what you, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your. W4 form 2023 2024, after setting the stage alight with a new, sixy avatar last season, ajinkya rahane hasn't quite found the same rhythm in ipl 2024.

Source: isadorawivett.pages.dev

Source: isadorawivett.pages.dev

Illinois W4 Form 2024 Devin Feodora, 2024 michigan income tax withholding. Form used to apply for a refund of the amount of tax withheld on the.

Source: blog.pdffiller.com

Source: blog.pdffiller.com

w4formemployeeswithholdingcertificate pdfFiller Blog, As before, you’ll need to provide your first and last name, social security number, home address, and filing status (single, married filing separately, married. For 2024, if you believe your itemized deductions will exceed $14,600 (if you’re single or married filing separate), $29,200 (if you’re married filing jointly), or $21,900 (if you’re the.

Since Tax Rules Change Over Time And Can Vary By Location And Industry, Consult A Cpa Or Tax Advisor For Specific Guidance.

We explain the five steps to filling it out and answer other faq about the form.

You Are Allowed To Claim Between 0 And 3 Allowances On This Form.

Department of the treasury internal revenue service.