Defined Contribution Limit For 2024

Defined Contribution Limit For 2024

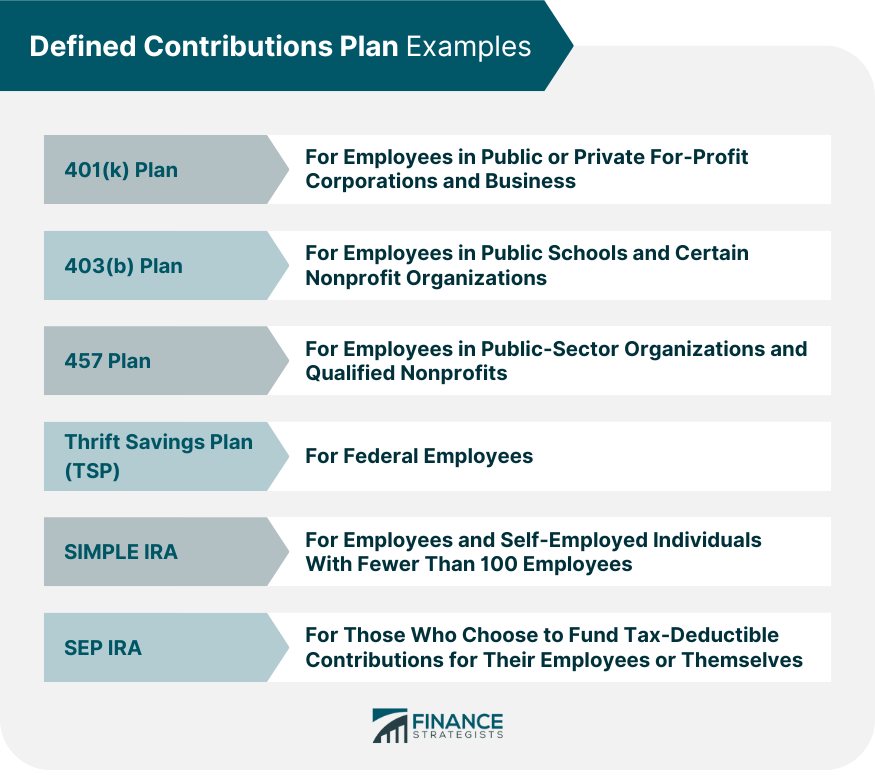

The table below shows the allowable contribution amounts and dollar limits. Contribution limits for 401(k)s in 2024 employee contribution limit.

Effective january 1, 2024, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that. This goes for employees covered by.

Defined Contribution Limit For 2024 Images References :

Source: gayleqregina.pages.dev

Source: gayleqregina.pages.dev

Defined Benefit Plan Contribution Limits 2024 Sibby Shaylynn, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401(k),.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, If you're age 50 or.

Source: berthebphaedra.pages.dev

Source: berthebphaedra.pages.dev

Irs Hsa 2024 Contribution Limits Norma, 100% of the participant's average compensation for his or.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2024 Perry Brigitta, (1) 100% of the employee’s average.

Source: www.pensiondeductions.com

Source: www.pensiondeductions.com

IRS Defined Benefit Plan Contribution Limits in 2024 PD, Simple ira 2024 contribution limit irs zarla.

Source: gayleqregina.pages.dev

Source: gayleqregina.pages.dev

Defined Benefit Plan Contribution Limits 2024 Sibby Shaylynn, The irs announced 2024 dollar limits on benefits and contributions for qualified retirement plans.

Source: gayleqregina.pages.dev

Source: gayleqregina.pages.dev

Defined Benefit Plan Contribution Limits 2024 Sibby Shaylynn, American employees can contribute up to $23,000 to their 401 (k) plans starting in 2024, up from $22,500 in 2023, the irs announced nov.

Source: dashaqhyacinthie.pages.dev

Source: dashaqhyacinthie.pages.dev

401k Catch Up Contribution Limit 2024 Ailis Arluene, The highlights of limitations that changed from 2023 to 2024 include the following:

Source: elianorawariana.pages.dev

Source: elianorawariana.pages.dev

401k Contribution Limits 2024 For Highly Compensated Employees Toma, The irs announced 2024 dollar limits on benefits and contributions for qualified retirement plans.

Source: joanqdorothea.pages.dev

Source: joanqdorothea.pages.dev

Hsa 2024 Contribution Limit Chart By Year Sheba Domeniga, The total contribution limit for both employee and employer contributions to 401(k) defined contribution plans under section 415(c)(1)(a) increased from $66,000 to $69,000.

Category: 2024